Add measurable value to your spend

analytics, data, sourcing, and procurement

Xeeva transforms indirect spend management with best practices around AI-powered, spend analytics, data, sourcing, and procurement solutions that drive better, more strategic decision-making and deliver real financial impact throughout your enterprise.

Request Demo

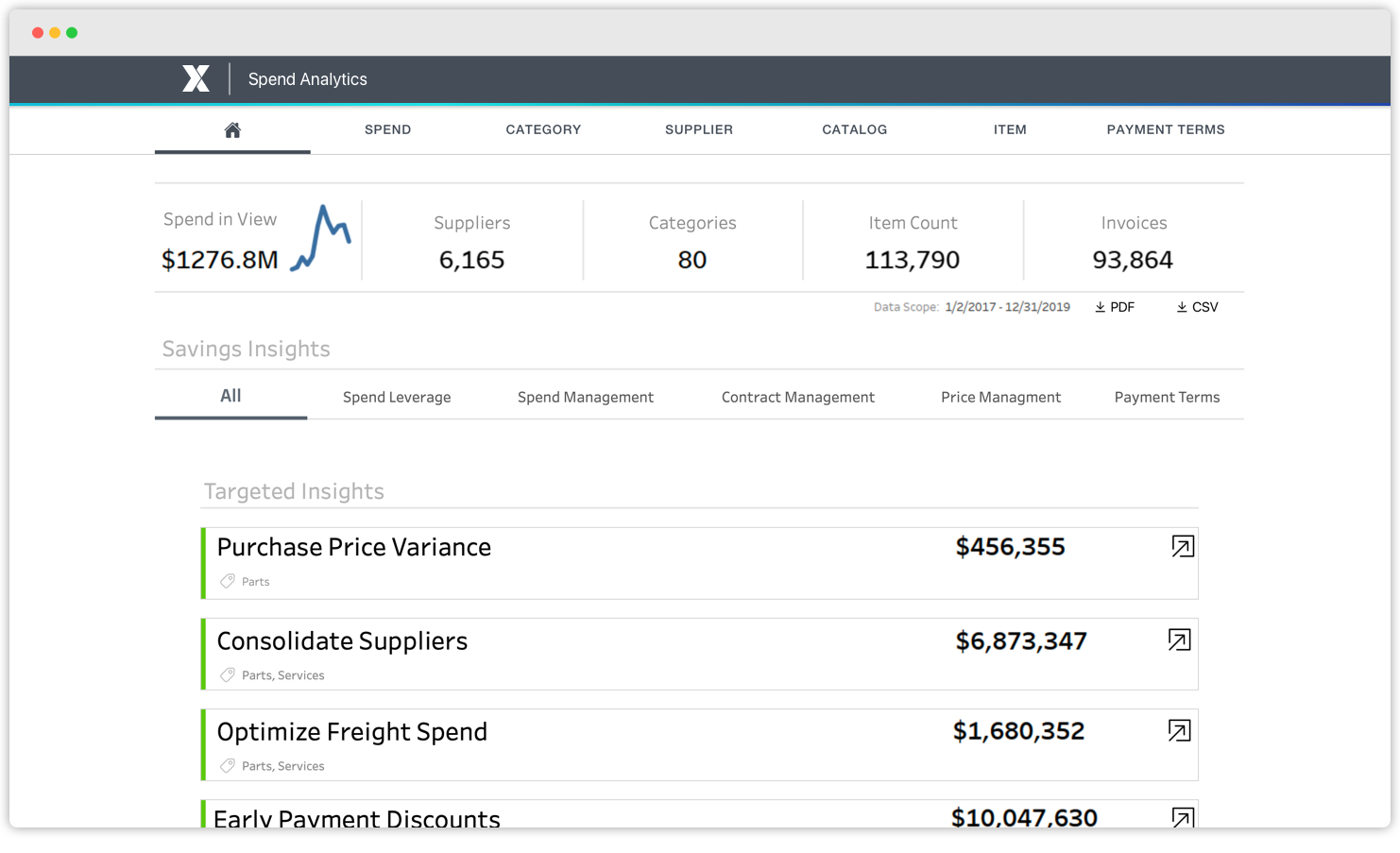

Spend Analytics

Xeeva Spend Analytics is a leading indirect spend analytics platform that enables highly accurate and actionable insights that deliver immediate ROI, cost savings, and best practices across the enterprise – all in a consolidated view.

Explore Product

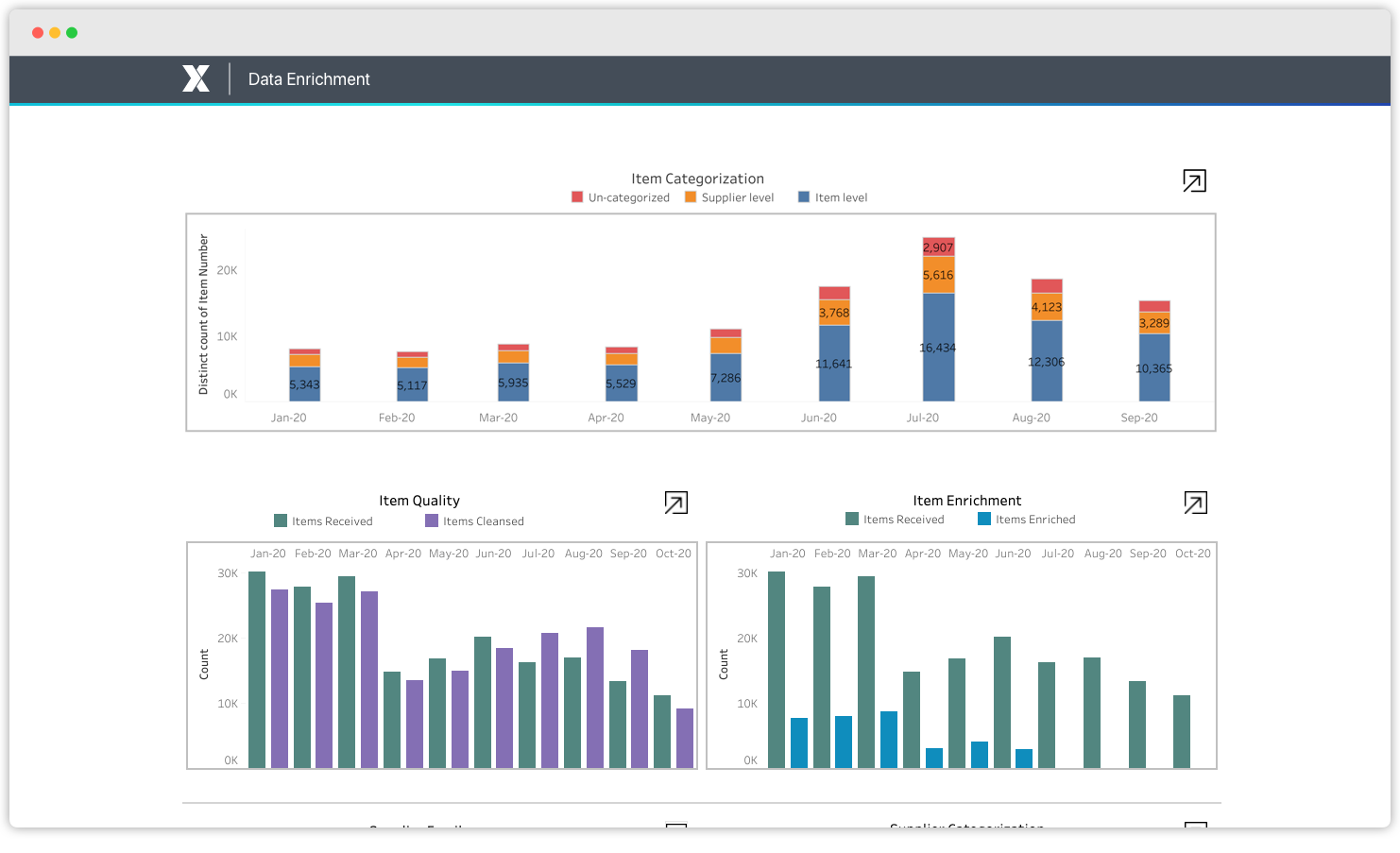

Data Enrichment

Xeeva Data Enrichment is the only AI-powered indirect spend data solution that thoroughly enhances imperfect data with granularity down to the part number and description, providing enterprises a clear, complete picture of their spend.

Explore Product

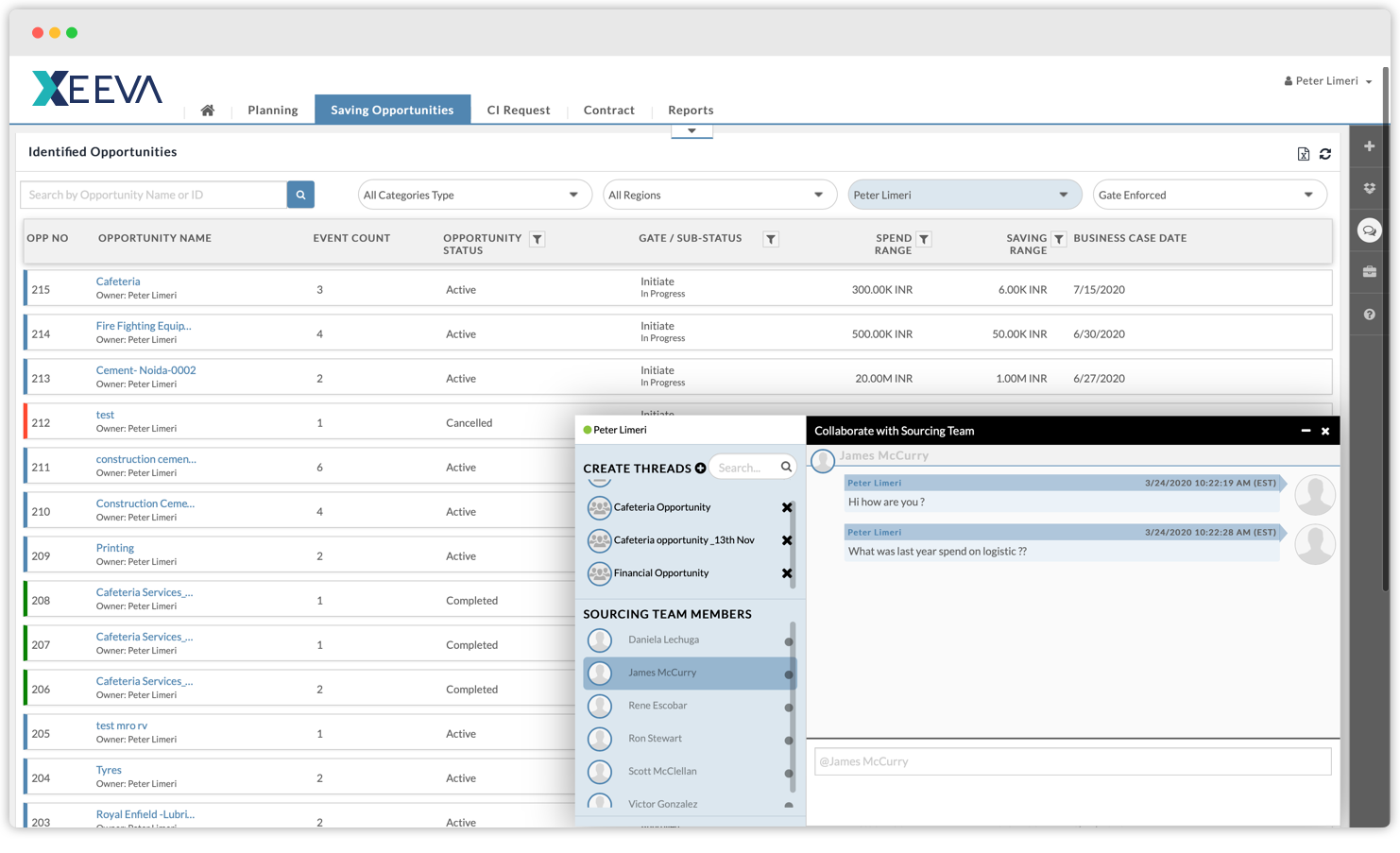

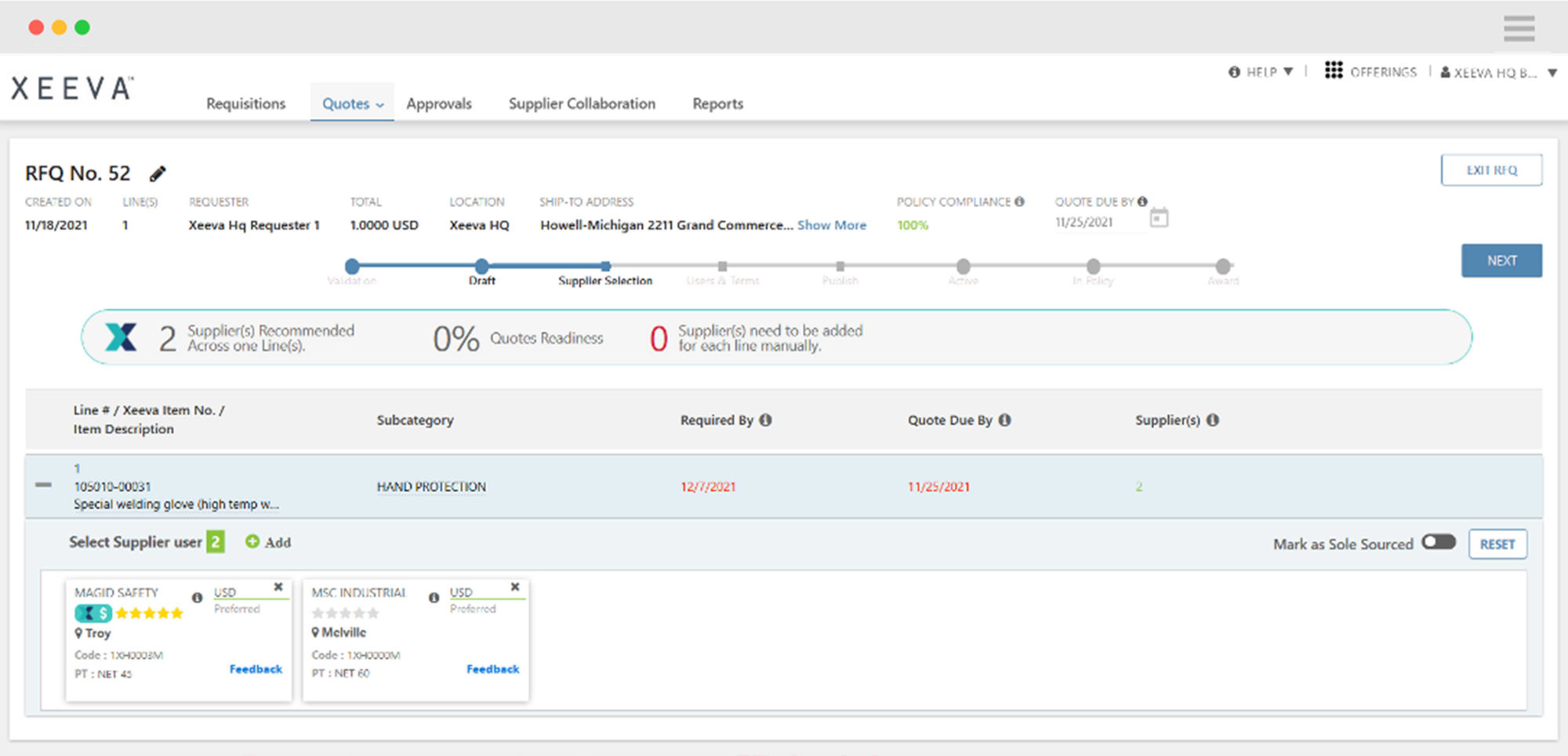

Sourcing

Xeeva Sourcing is a strategic sourcing solution that leverages deep spend category expertise and superior supplier and product data to identify optimal suppliers, reduce time to contract, minimize indirect spend, and simplify compliance with corporate sourcing guidelines.

Explore Product

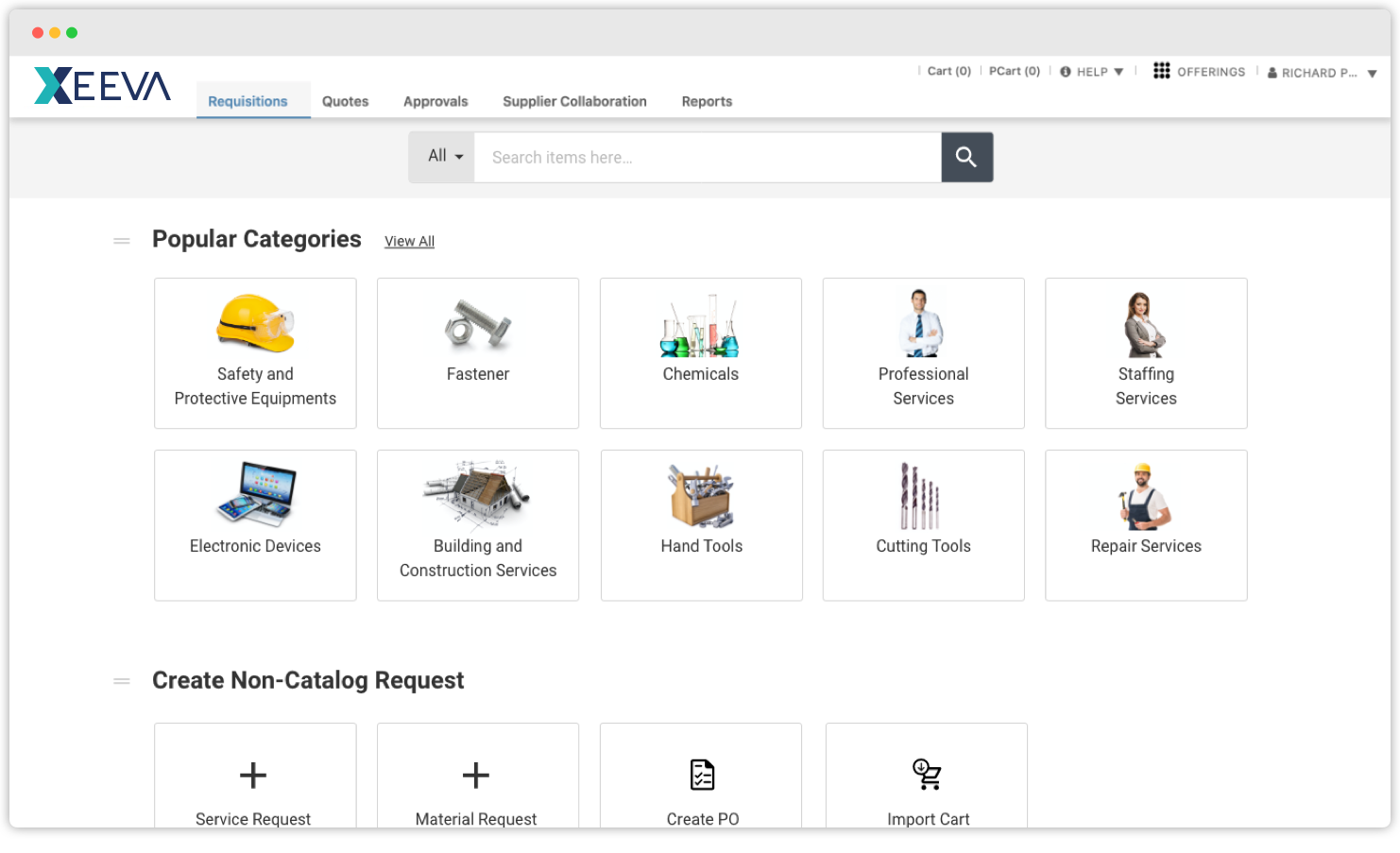

Procure-to-Pay

Xeeva Procure-to-Pay is a simpler procurement solution that allows you to procure all goods and services while bringing you full visibility, control, and management of your indirect spend.

Explore Product

XpressBUY

XpressBUY by Xeeva is an easy-to-use purchasing software connecting customers to Xeeva Marketplace Suppliers in an inexpensive way, allowing for bottom-line savings and elimination of the cumbersome RFx process.

Explore Product